Stablecoin trading is the engine of decentralized finance (DeFi), and this article explores how Curve Finance keeps it running smoothly through low-risk, low-fee swaps and decentralized governance.

Curve Finance is a decentralized automated market maker (AMM) protocol, a type of decentralized exchange (DEX), tailored for stablecoin trading. Instead of using a traditional order book to match buyers and sellers, Curve enables token swaps through smart contracts and liquidity pools (LPs). This offers low slippage and minimal fees when trading similarly priced assets.

Launched in January 2020 by Michael Egorov, Curve has grown into one of the most influential protocols in DeFi, especially for users seeking efficient and low-risk stablecoin exchange.

Curve uses an AMM model that relies on smart contracts rather than centralized intermediaries. Each Curve pool is a collection of tokens with similar prices, typically stablecoins, that users can swap efficiently.

Instead of matching buy and sell orders, Curve uses a pricing algorithm called StableSwap, which adjusts the swap rate based on the balance of tokens in the pool. It’s designed explicitly for assets with similar values, like stablecoins, allowing trades to happen with minimal price impact and slippage.

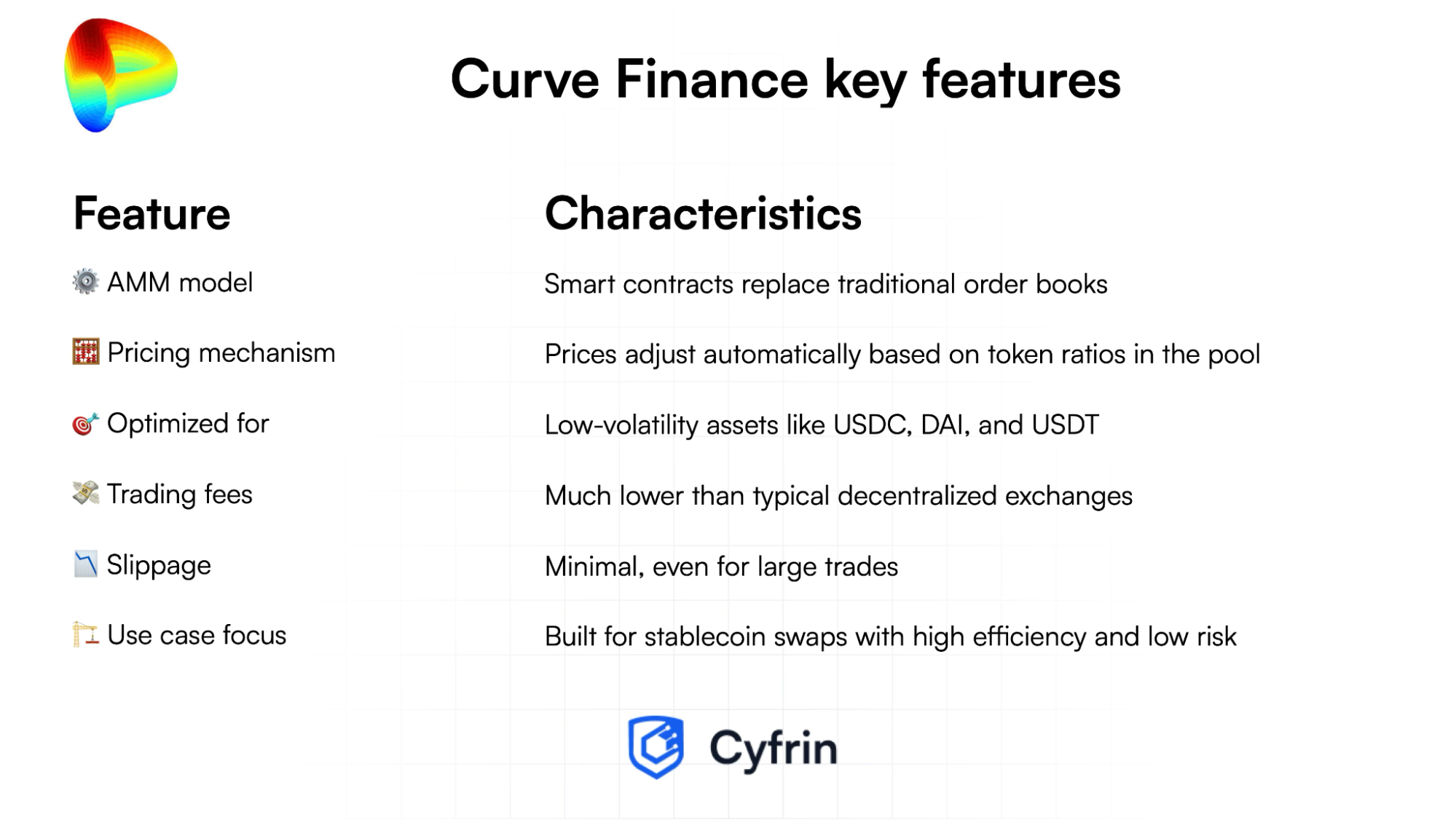

Here’s what distinguishes Curve from other DEXs:

Curve’s approach focuses on value precision instead of speculation opportunities to create an efficient trading environment for stablecoins like USDC, DAI, and USDT.

Smart contracts on Curve manage everything: swaps, balances, rewards, and fee allocation. The platform supports several pool types, each designed for specific DeFi use cases:

Liquidity providers deposit assets into these pools and earn a share of the trading fees, which are capped at 0.04%. Because most Curve pools contain stable-value assets, the risk of impermanent loss (when token prices diverge from each other) is much lower than on other AMM platforms.

The CRV token is the governance token of Curve Finance. CRV incentivizes liquidity provisioning and allows users to participate in protocol governance.

Users who lock their CRV tokens receive veCRV, which gives them voting power and a share of trading fees, both of which increase with the amount locked and the length of the lock period.

veCRV holders can vote on:

This structure ensures that those with a vested, long-term interest in Curve have a say in its future, aligning incentives between users and the protocol.

Curve’s governance system rewards long-term participation. Users who lock their CRV for longer durations gain more voting power and a larger share of platform fees. This has led to what the DeFi community calls the Curve Wars, a battle among protocols to accumulate veCRV and direct CRV emissions to their preferred pools.

Why protocols compete for veCRV:

This dynamic has made veCRV a sought-after governance asset in DeFi, linking Curve’s growth to the goals of those protocols seeking to benefit from it.

Curve’s design focuses on stablecoins and other tokens that consistently trade at similar prices, such as different wrapped versions of the same asset (e.g., wBTC and renBTC).

Advantages of focusing on this niche include:

In short, instead of attempting to support all trading pairs, Curve concentrates on doing one thing very well: facilitating low-cost, efficient swaps for stable-value assets.

This specialization has made it the go-to DEX for DeFi protocols requiring stablecoin liquidity.

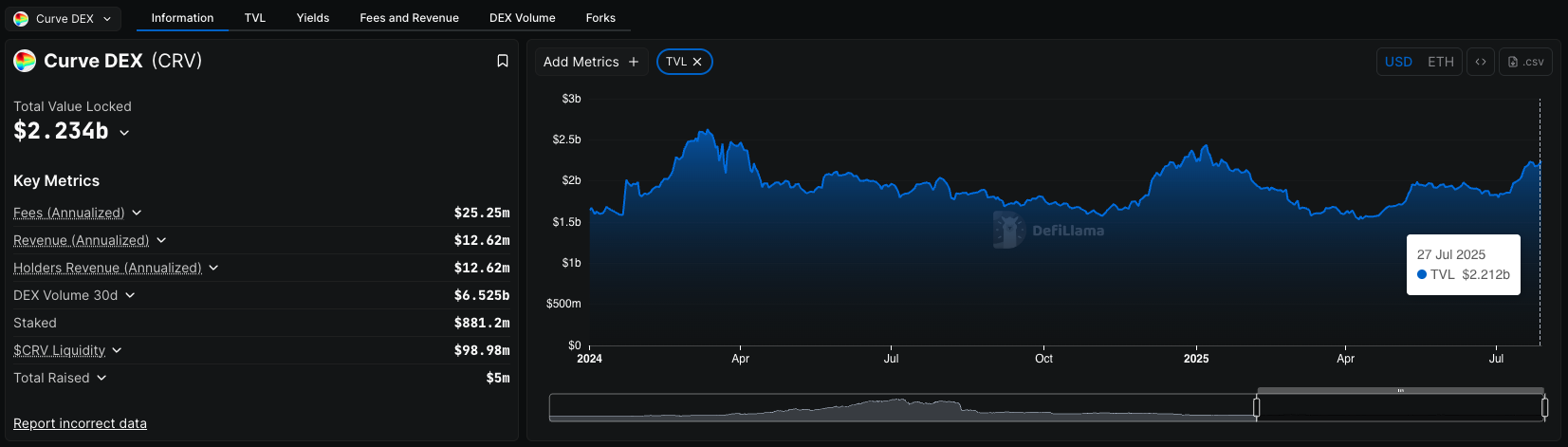

Curve consistently ranks among the top protocols by total value locked (TVL), a metric that reflects user trust and capital commitment. Its TVL reached 24B USD toward the end of 2022, and currently hovers around 2.25B USD, which puts it among the top 3 DEXs by TVL, just behind Uniswap and Raydium.

The protocol also supports multiple blockchain networks and Layer 2s, including:

This multi-chain presence increases accessibility and reduces transaction costs for users operating outside Ethereum.

Curve enables composability and efficiency across DeFi. Many applications rely on Curve for stable liquidity, especially when building products that require dependable yield or low-risk swaps.

Key integrations include:

These integrations help Curve function as a core building block for DeFi infrastructure.

Curve Finance is a decentralized exchange and automated market maker optimized for low-risk, stablecoin trading. It replaces the traditional order book model with smart contracts and liquidity pools, enabling efficient swaps between stable-value crypto assets.

The platform introduced the CRV token as both an incentive mechanism and a governance token. Through the vote-escrow model, veCRV holders gain voting power and a share of platform fees, encouraging long-term engagement.

With billions in total value locked, a stablecoin-centric design, and integrations across DeFi, Curve is a foundational layer of decentralized finance. Its role in enabling stablecoin trading, fee optimization, and governance makes it essential infrastructure for DeFi users and builders.

Take this knowledge and turn it into skill: Dive deeper and learn to build with Curve on Cyfrin Updraft: